Best Online Casinos In Cyprus

⏲️ Reading time: 23 minutes

Best online casinos in Cyprus have gained notable popularity, driven by a global interest in online sports gambling. Despite Cyprus's small population, the gambling market has seen significant revenues, with a recorded 118 million euros in 2020.

The market offers diverse gaming experiences with slots, table games, and live dealer options supported by secure payment methods like credit cards, e-wallets, and cryptocurrencies.

| Rank | Casino | Rating | Bonus | Get bonus |

|---|---|---|---|---|

| 1 |  888Starz | 4.3/5 | 100% welcome bonus up to €1,000 | Read review |

| 2 |  20Bet | 4.5/5 | 100% WELCOME BONUS UP TO 100 EUR | Read review |

| 3 |  22Bet | 4.5/5 | 100% welcome bonus up to €122 | Read review |

| 4 |  1xbet | 4.8/5 | Welcome package up to 1,950 EUR + 150 free spins | Read review |

| 5 |  Megapari | 4.8/5 | 100% welcome bonus up to 290 EUR | Read review |

Explore top casinos in Cyprus with details on bonuses, game selections, mobile compatibility, and overall usability. This guide is designed to help you find a secure and enjoyable casino that meets your preferences.

There are numerous casinos out there, and they all have unique features. However, this guide will point you to the right places to play your favorite games. Whether it is a huge bonus or a variety of games you want, Cyprus has top-rated casinos for all players.

We’ll highlight each of the casino’s strengths and features in this guide. Below are some of the top-rated online casinos in Cyprus:

The path to legalized gambling in Cyprus was gradual. Before widespread legalization, only a few gambling activities, like horse racing betting (legalized in 1973) and lotteries (legalized in 1983), were permitted.

Cyprus's entry into the European Union in 2004 marked a period of unregulated gambling, with EU member states' online gambling platforms often accessible to Cypriots. It wasn't until 2012 that the Betting Law was implemented, regulating the gambling industry and introducing the National Betting Authority to oversee and license online casino site operators.

Most casinos in Cyprus are concentrated in the Turkish Republic of Northern Cyprus. Turkey's casino ban in 1998 boosted Cyprus' gambling industry as Turkish casino workers moved to the island.

Despite the growth in land-based gambling, online 1 Euro casino gambling remains under-regulated in Cyprus. The law does not permit online casino licenses except for sports betting. While betting operators can legally offer online sports betting, many Cypriots still use unlicensed foreign gaming and betting sites.

The lack of stringent government measures against unlicensed online gambling has led to its increased popularity, especially among the youth, with recent studies indicating that 22% of Cypriot youth participate in online gambling, surpassing the European average.

In Cyprus, the regulatory landscape for best new casinos is defined by a combination of legal allowances and restrictions. Land-based casinos are permitted, provided they operate as part of a resort, hotel, or spa and are limited to table and card games with a specific cap on slot machines.

In contrast, online casino gaming is predominantly illegal, excluding services offered by OPAP, the Greek lottery company. This monopoly extends to both online and offline lotteries.

Online poker and bingo are illegal, with Cypriot ISPs actively blocking access to related sites. However, players are not penalized for accessing these games on foreign platforms.

Sports betting is an exception in the online gambling laws and regulations in Cyprus, being legally offered by OPAP and other licensed companies, though with restrictions on certain betting forms like dog racing.

| 🌎 Country | Cyprus |

| 👌 Language | Greek, Turkish |

| 💶 Currency | Euro (€) |

| 🎰 Popular Casino Games | Slots, Blackjack, Roulette |

| ⚖️ Is Gambling Legal? | Yes, both land-based and online gambling are legal in Cyprus. |

| 🕵️ Gambling Regulator | National Betting Authority of Cyprus |

| 📃 Gambling Tax | Winnings from gambling are subject to a 12.50% tax. |

| 💳 Popular Payment Methods | Visa, Mastercard, Maestro |

The beautiful island of Cyprus, known for its rich history and stunning landscapes, has also become a notable player in online gaming. Leading this sector are five distinguished online casinos.

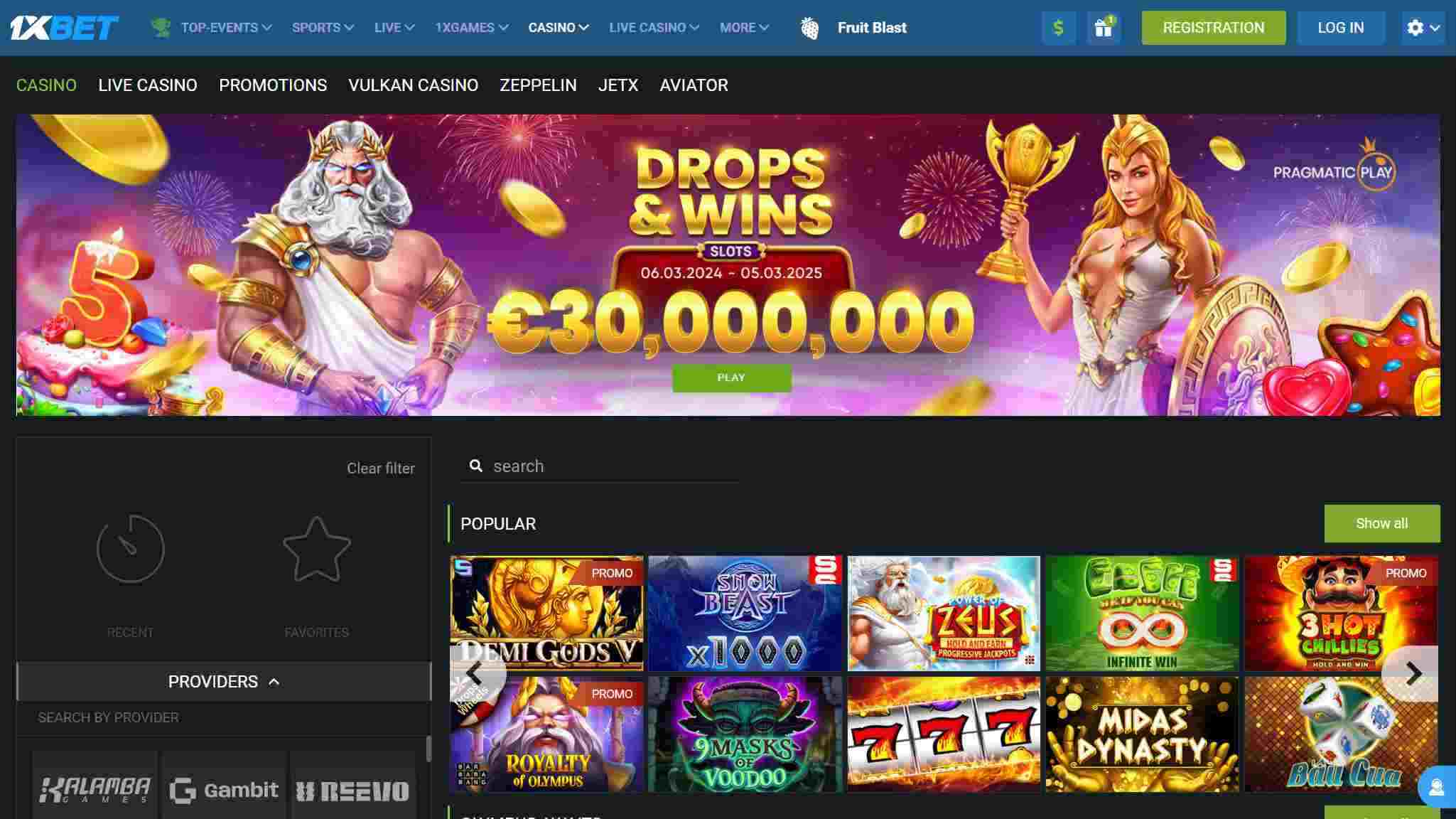

1xBet is a well-known online casino in the Cypriot online casino space, recognized for its vast array of gaming options.

| 💰 Welcome Bonus | Up to €1500 |

| 🎲 Popular Casino Games | Slots, table games, live casino, poker |

| ♠️ Suppliers | NetEnt, Microgaming, Playtech |

| 💳 Payment methods | Visa, Mastercard, Skrill, Neteller, Bitcoin |

| ⚠️ Minimum Deposit | €1 |

| 💬 Customer Service | Live chat, email, phone |

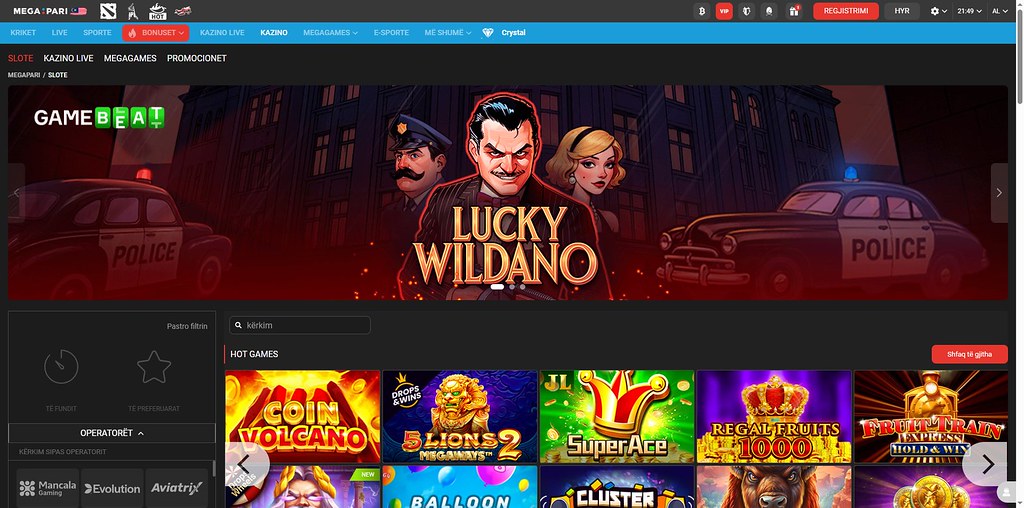

Megapari stands out in the Cypriot online casino industry for its impressive selection of games. It is favoured by many players for the following reasons.

| 💰 Welcome Bonus | Up to €300 + 150 FS |

| 🎲 Popular Casino Games | Slots, table games, live casino, poker |

| ♠️ Suppliers | Pragmatic Play, Betsoft, Red Tiger Gaming |

| 💳 Payment methods | Visa, Mastercard, Skrill, Neteller, Cryptocurrencies |

| ⚠️ Minimum Deposit | €1 |

| 💬 Customer Service | Live chat, email, phone |

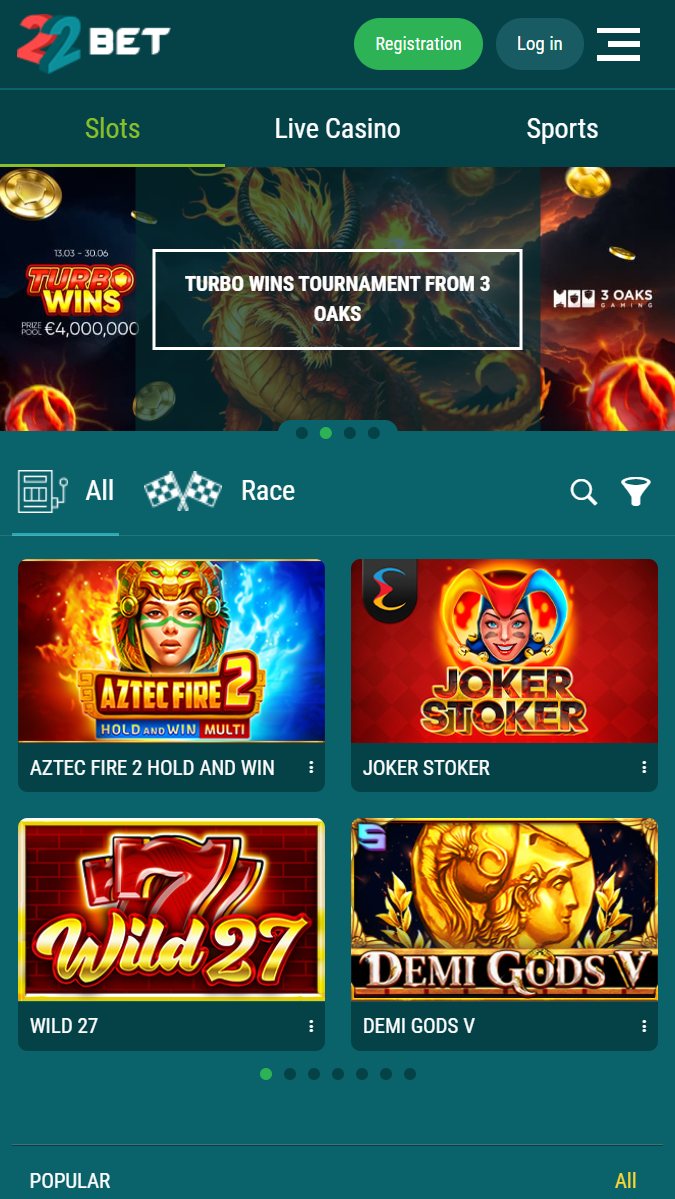

22Bet is recognized in the Cypriot casino industry for its various casino games. This platform attracts many players with its attractive promotions and high-quality games.

| 💰 Welcome Bonus | Up to €122 |

| 🎲 Popular Casino Games | Slots, table games, live casino, poker |

| ♠️ Suppliers | Quickspin, Yggdrasil, Play’n GO |

| 💳 Payment methods | Visa, Mastercard, Skrill, Neteller, Cryptocurrencies |

| ⚠️ Minimum Deposit | €1 |

| 💬 Customer Service | Live Chat, Email, Phone |

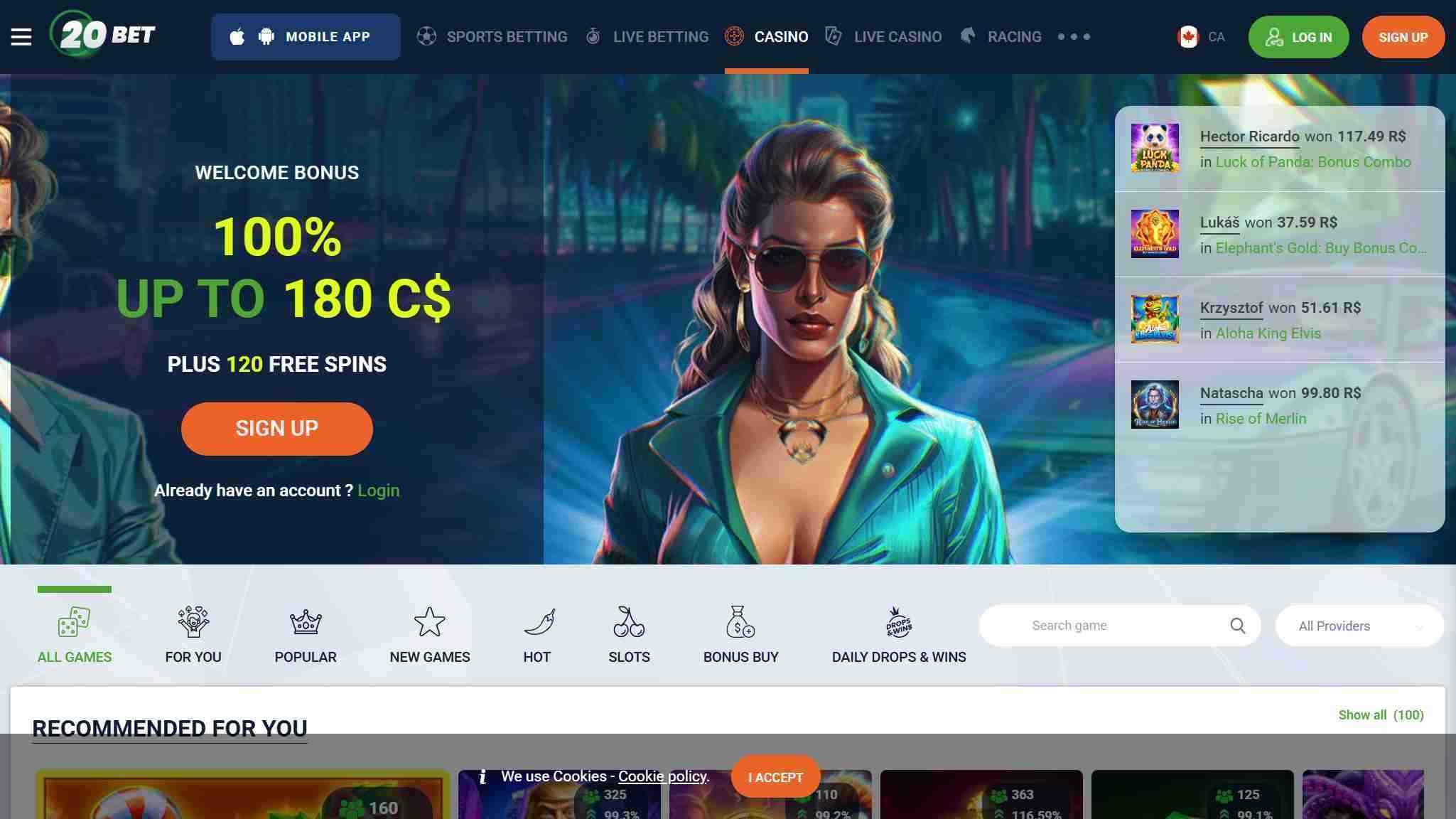

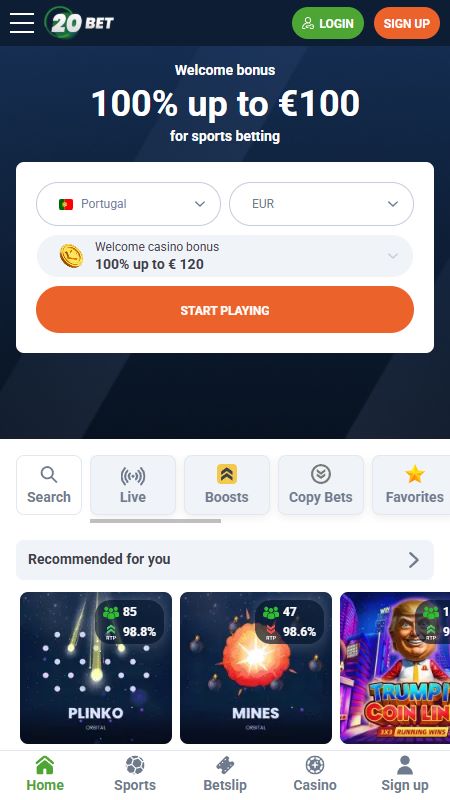

20Bet is prominent in the Cypriot online casino market, known for its high-quality selection of casino games and bonuses.

| 💰 Welcome Bonus | Up to €120 + 120 FS |

| 🎲 Popular Casino Games | Slots, table games, live casino, poker |

| ♠️ Suppliers | ELK Studios, Push Gaming |

| 💳 Payment methods | Visa, Mastercard, Skrill, Neteller, Cryptocurrencies |

| ⚠️ Minimum Deposit | €5 |

| 💬 Customer Service | Live chat, email, phone |

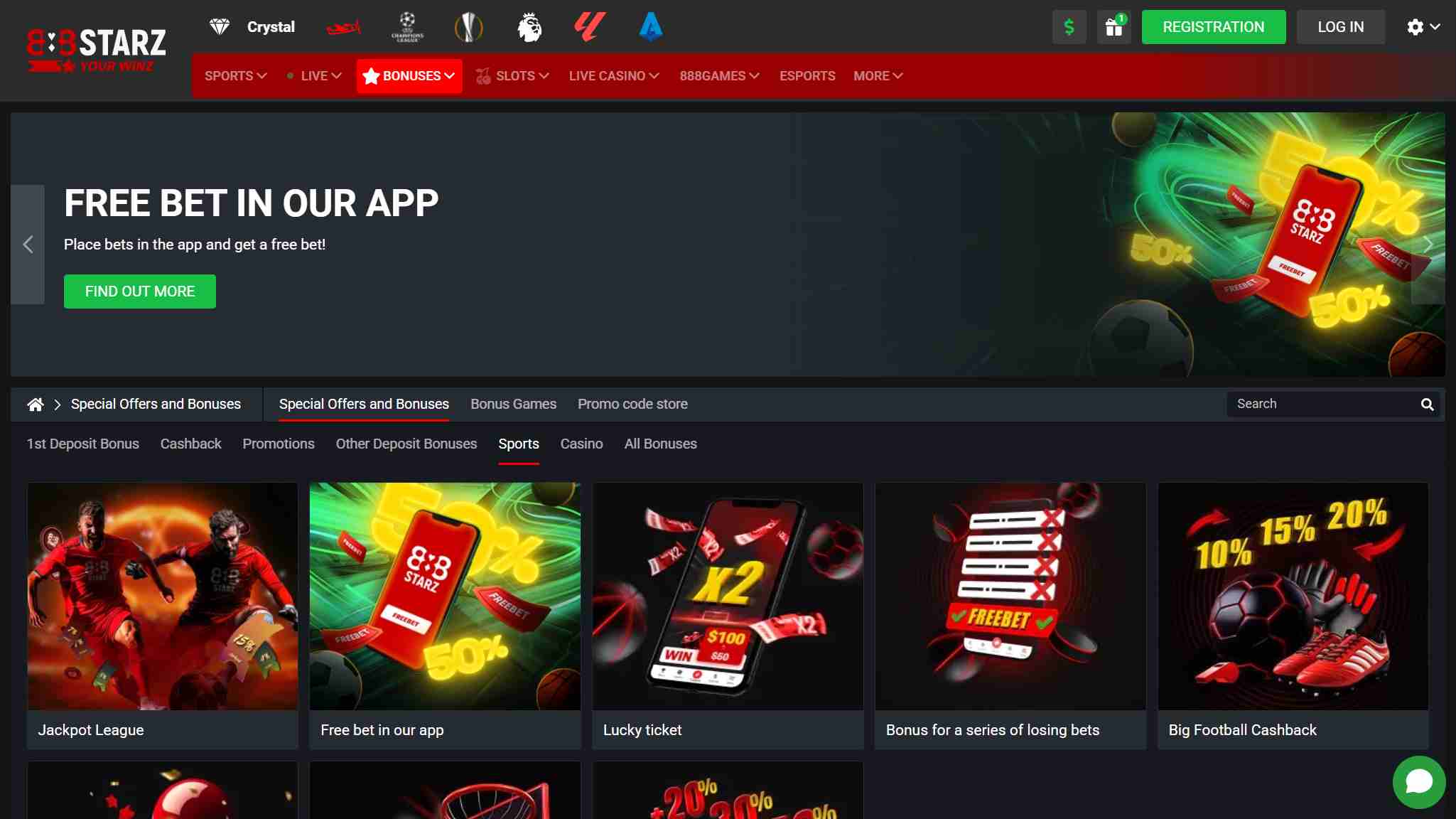

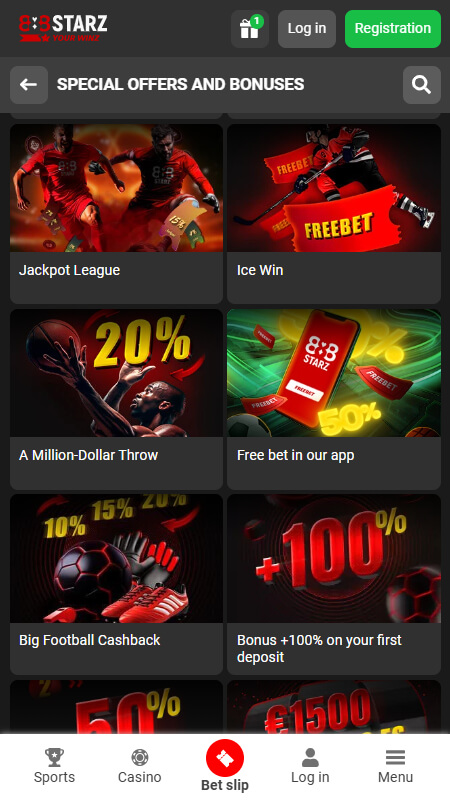

888Starz is a unique player in the Cypriot online casino scene, offering a blend of traditional casino games and innovative blockchain-based gaming.

| 💰 Welcome Bonus | Up to €1,500 + 150 FS |

| 🎲 Popular Casino Games | Slots, table games, live casino, poker |

| ♠️ Suppliers | Endorphina, Habanero, Booming Games |

| 💳 Payment methods | Visa, Mastercard, Skrill, Neteller, Cryptocurrencies |

| ⚠️ Minimum Deposit | €1 |

| 💬 Customer Service | Live chat, Email, Phone |

Explore Cyprus's top online casinos with our concise comparison. We evaluate the best options, comparing features and gaming experiences.

Our experts review all online casinos based on the most important criteria. Our casino rating includes the security, games, bonuses, and payment methods on offer. That way, we can assure online gamblers in Cyprus of safe, fun, and trustworthy sites. Among the things to consider here are some of the more important ones:

A proper license is essential when choosing a Cypriot online casino. A license ensures the casino operates under strict regulations, meaning your money is safe. Only casinos licensed by respected authorities are recommended here, so players can trust the sites to provide fair play and secure transactions.

Reliability is crucial for any online casino. Here, we only recommend trustworthy platforms that protect user data with SSL encryption. These casinos have a proven track record, with positive feedback from many players who feel confident in their safety and security when playing.

Generous bonuses are always a plus, especially for newcomers. We grade casinos on their bonus offerings so players can be sure to get the best value. From welcome bonuses to continuing promotions, an attractive bonus casino offers you even more to play with and, consequently, more opportunities to win.

The best casinos really do offer variety to the players. We look for sites that have a large game collection. That way, there will be many online games for everyone. The more options a casino has, the easier it is to try something new.

Payment options are important to make the experience smooth. The best online casinos support multiple payment methods— ranging from credit cards to eWallets. It will give players the option of which one suits them best. This flexibility can make deposits and withdrawals more convenient.

Good support means getting help when you need it. It is important that online casinos assist their customers. We scrutinize the support for each casino, looking at the time it takes for them to respond. We also consider the modes you can use to reach them, such as live chat or email.

Here is our guide to help you play your first game at an online casino:

Visit your chosen online casino’s website. Sign up by providing your personal details.

Choose your preferred payment method and make a deposit. Check the available bonuses and claim them if applicable.

Browse the gaming library and select a game to start playing. Read the game rules and enjoy playing.

If you had to make a choice between online and land-based casinos, which would it be? Before you do, it’s very important to understand the advantages and disadvantages of each. Below is a quick comparison:

| Pros and Cons | Online Casinos | Land-Based Casinos |

|---|---|---|

| 👏 Convenience | Play anytime, anywhere | Requires traveling |

| 🎮 Game Variety | Wide range of games | Limited to a casino’s collection |

| 🤝 Social Interaction | Limited (unless live games) | High; interact with players and dealers |

| 🎁 Bonuses | Generous welcome and deposit bonuses. | Rare or low bonuses |

| 😎 Atmosphere | Virtual only | Unique casino ambiance |

Online casinos offer different kinds of bonuses to encourage new and continuing gamblers. They give out these offers to encourage people to join them. Both new and loyal casino players stand to benefit from these incentives; they allow them to have more play time and possibly increase their winnings.

To enjoy any bonus offer, you need to ensure that you are registered with the casino. You will mostly find casino bonuses clearly advertised on the website. Most Cypriot casinos have a dedicated page for promotional offers where you can learn what they have in store for their players. There are many types of bonuses you will come across at Cypriot online casinos, and we’ve covered some of the most popular ones below.

The welcome bonus is for new players who are just starting out on the site. They will either get a first deposit bonus or free spins, but sometimes they may get both. The bonus may differ in size across different casinos, but usually, it is the biggest incentive a player can get. They will give you the welcome offer only after you make your first deposit. However, be sure you read the fine print before using any promotion.

As we already mentioned, the casino will give you a bonus after you make your very first deposit. These come in matched percentages, usually around 100%. As such, you get to double your deposit, and you can use it to play the games. You won’t be able to withdraw anything until you meet the wagering requirements for the bonus.

Many of the top-rated casinos give out free spins from time to time. Generally, these can be used on specific slot games. Sometimes, they even come as part of the deposit bonus. Free spins allow Cypriot players to test out an online slot without spending any money. To get the incentive, choose a casino offering free spins and opt-in for their free spin bonus. Note that they come with wagering requirements. You’ll need to play through the winnings from the spins a certain number of times before you’ll able to withdraw.

Some casinos offer no-wager free spins, although this is extremely rare. If you come across them, the casino lets you keep your winnings straight away without any playthrough requirements.

Cashback bonuses allow you to recover some of the money you used to wager. The casino may give you a certain percentage of your bet back if you lose. This bonus could be part of their weekly offers or a VIP reward.

These programs are designed for the most loyal players on the site and sometimes the casino invites everyone to join. These programs reward users with certain benefits, such as higher cashback rates, quicker withdrawals, and personal account managers. They even send them invites to special events. Most of the programs are structured into multi-tiered systems where players advance depending on how often they play games. Each level will provide players with greater rewards until they attain VIP status.

The Cypriot gambling legislation, reflecting the island nation's approach to both land-based and online gambling, is structured through various laws and regulatory frameworks. Key among these is the distinction between different types of gambling activities and the stringent conditions set for their operation.

The age restriction is a fundamental provision in the Cypriot gambling legislation. The legal age for participating in real money casino activities, whether in land-based casinos, sports betting facilities, or online sports betting platforms, is set at 18 years.

This rule is stringently enforced, with operators mandated to verify the age of their customers. Non-compliance with these age verification requirements can lead to severe consequences for operators, including hefty fines and the potential revocation of their licenses.

The Betting Law 2012 was pivotal in Cyprus’s gambling legislation, establishing the National Betting Authority (NBA). The NBA plays a crucial role in overseeing gambling activities, including handling registration applications, awarding licenses, conducting audits, and supervising gambling operators.

Another significant regulatory body is the National Gaming and Casino Supervision Commission (NGCSC). The legal framework in Cyprus shows a distinct approach towards land-based and online gambling.

For instance, free game casinos like poker, blackjack, video slots, and Fortune Wheels are not legally permitted. Land-based gambling, on the other hand, is subject to stricter regulations.

In Cyprus, there are two primary types of gambling licenses for new casinos in Cyprus:

Class A License: This covers land-based gambling premises and is essential for operators of physical gambling venues.

Class B License: This is for operators who intend to conduct remote or online betting operations, focusing primarily on sports betting.

To legally operate a no-deposit bonus casino in Cyprus, a company must fulfill several criteria, including partnership or physical presence, a clean criminal record, and a specified capital endowment.

The financial obligations include an entry fee, license cost, and a paid-in capital requirement. Notably, all transactions must be cashless. The tax regime for licensed sportsbooks involves a flat rate of 13%, a combination of a betting tax and a contribution to the regulatory authority.

In Cyprus, online gambling taxation is characterized by a clear and straightforward framework. Licenses for online gambling, primarily intended for companies within the European Union, are issued for 1 to 2 years, with the possibility of extension through relevant applications. The National Betting Authority can suspend or revoke licenses if non-compliance with the law exists.

A significant aspect of this taxation system is the flat tax rate of 13% applied to every licensed sportsbook. This rate comprises a 10% betting tax and a 3% contribution to the Authority. It's important to note that Cyprus has specific regulations regarding online gambling activities.

For instance, only sports betting is permitted as online gambling. Additionally, Cypriot law prohibits minors under 18 from attending betting shops and participating in lottery draws. Minimum deposit casinos in Cyprus can be funded using cards and digital wallets, but cash payments are prohibited.

The most popular casino games in Cyprus include various options that cater to different player preferences. These games are accessible on online casinos accepting players from Cyprus. They include:

Slots are known to be favorites with players. You only need to spin the reels to win—the games aren’t complex. They come in different variations and themes. You can play classic slots or even progressive jackpots at the best casinos in Cyprus. Most of the video slots have brilliant graphics and impressive features.

The progressive jackpot slots are usually the highlight of most of these casinos and are in very high demand because of the large prizes attached to them.

Blackjack is another popular game in Cyprus. It involves dealing cards. You win if you can beat the dealer by getting close to 21— but not over it. The biggest casinos host many variants from software giants like Pragmatic Play and Evolution Gaming.

Blackjack is a game of strategy, unlike slots, giving players the best chances of winning. By learning basic strategies, players can actually improve their odds. There are numerous variants, too, such as European Blackjack and Blackjack Surrender, each with its own rules and slight twists to keep the game interesting. Most casinos also feature both regular and live versions of blackjack.

Roulette involves predicting where the ball will land on the spinning wheel. Unlike the other games, you can make multiple bets in roulette. You can wager on one number or a sequence of them or the colors red and black.

Like blackjack, there are also a lot of variations of this game. You can play popular versions such as European and American roulette. You can also play this at the live casino. It is also a game of strategy, and that is why many players love it. Many use common strategies like the Martingale system to win.

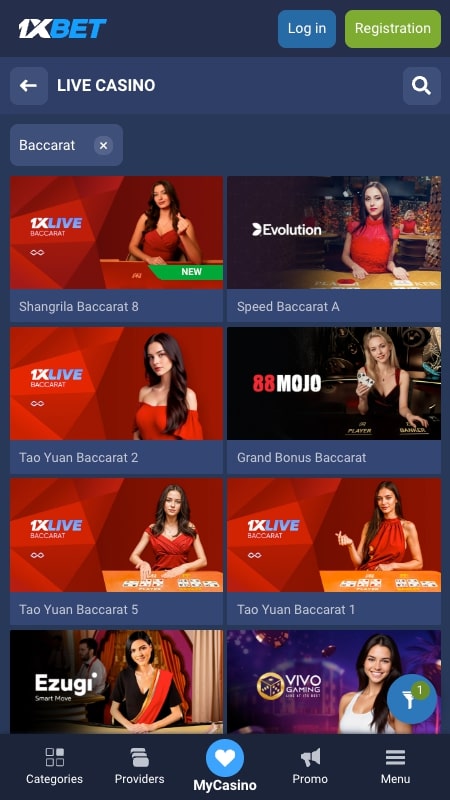

Also known as Punto Banco, Baccarat is a game of chance. It is a favorite among high rollers because of its sophistication. Baccarat started out in France, and today, it is one of the most popular games at any casino. The game involves comparing the cards dealt to the player and the banker in the hope that a hand value comes close to nine. The rules of Baccarat are pretty simple, and it has a pretty minimal house edge. Like the other table games, Baccarat also has variants. You can play the classic version or popular titles like Mini-Baccarat and Chemin de Fer, among others.

Poker is a very entertaining game and is easy to play. It has a regular and live version at most casinos. Here, players are dealt five cards. The goal is to make the best possible value poker hand. There are many variations, like Jacks or Better, Deuces Wild, and Joker Poker. The game is fairly self-explanatory. Also, with a good strategy, you can increase your chances of winning.

With more people using their phones for everything, mobile casinos are now a standard feature of online gambling. Casinos in Cyprus are designed to work smoothly on both iOS and Android devices, thanks to HTML5 technology, which has replaced older Flash plugins. This ensures that players can enjoy a fast, high-quality gaming experience on mobile. While not all slots and table games are available on mobile, the most popular ones are optimized for smaller screens, so you can play them wherever you are.

In Cyprus, casino apps have become popular among players due to their usability, game variety, and secure payment methods. Casino apps provide a convenient way to enjoy games on the go, whether you’re using an iPhone, Android, or tablet. Here are some of the most popular casino apps in Cyprus, along with a comparison of their features and advantages:

A live casino offers a thrilling gaming experience. Games hosted in a live casino include blackjack, roulette, and baccarat. These offer an immersive experience because they are streamed live. You can watch the dealer and play in real time from the comfort of your own home.

The best casinos in Cyprus feature real tables and professional dealers. The games bring the ambiance of a land-based casino onto the screen. Also, since live casino tables have higher betting limits, players have the opportunity to raise high stakes.

There are a good number of live dealer games that members can play. The best sites feature classic table games and new variations of them. Live dealers are great for those who want an experience similar to playing at a land-based casino.

New online casinos are popping up every day. Hence, Cypriot players have more options for bonuses and new games. Here are five of the latest casinos available to players in Cyprus:

These are the latest casinos to join in Cyprus. They are licensed and will offer a fantastic gaming experience.

In Cyprus's online casino sector, the richness of the gaming experience is enhanced by a broad range of payment methods. These options, ranging from traditional credit and debit cards to efficient e-wallets and crypto casinos, cater to diverse player preferences, ensuring ease and security in transactions. This approach underlines the industry's commitment to inclusivity and user-friendliness, fostering a welcoming and dynamic gaming environment.

| Payment Options | Deposit Time | Withdrawal Time | Deposit Limits | Withdrawal Limits | Available at: |

|---|---|---|---|---|---|

| Neteller | 1-5 minutes | 1-3 business days | €10 – €50,000 | €10 – €50,000 | 24/7 Cyprus |

| Visa | 1-5 minutes | 3-5 business days | €10 – €10,000 | €10 – €10,000 | Cypern Slots |

| Bank Transfer | 1-2 business days | 3-5 business days | €10 – €100,000 | €10 – €100,000 | Cypern Slots |

| Cryptocurrency | 1-5 minutes | 1-2 business days | €10 – €100,000 | €10 – €100,000 | Casumo |

In Cyprus, the online casino scene has witnessed some remarkable successes, with players achieving significant wins across various games. Over the last five years, Cypriot players have amassed a total of $3,806,824 from 510 wins, averaging around $7,464 per win on the best fast-payout casino. The data reflects this ongoing trend of impressive achievements.

Among the top performers, Panayiotis P stands out, having secured four major wins. His most notable victory came from the slot game "Goldaur Guardians," where he won a staggering $182,400. Panayiotis P also enjoyed success with "Cat Clans," winning $129,415. These substantial wins place him as one of the most successful online casino players in Cyprus.

Another notable player, Nicholas M, demonstrated prowess in "Double Double Bonus Poker," securing wins of $81,000 and $73,885 on mobile casinos in Cyprus. His consistency in this game highlights his skill and strategy in video poker.

Other players like Mikhail L and Julie D also feature in the list of top winners. Mikhail L's winnings were significant in games like "All Win FC" and "Jewels of the Orient," whereas Julie D's notable win was in "Little Chief Big Cash."

These successes not only highlight the potential for significant wins in online casinos but also showcase the diverse range of games favored by players in Cyprus.

The future of Cyprus's casino industry is shaped by the recent opening of the City of Dreams Mediterranean in Limassol, the largest in Europe, offering extensive gaming and leisure facilities. However, no new casino projects are currently planned, largely due to Cyprus's strict gambling regulations.

The country has a highly regulated environment, with only one land-based casino license issued and a complete ban on live casinos in Cyprus. This approach limits the expansion of the casino sector in Cyprus, focusing on controlled and limited gambling ventures.

For beginners who want to increase the chances of winning, here are some tips to get started:

Even though there’s no sure way to win, these tips will help increase your odds. Remember to play responsibly and only bet what you can afford to lose.

Here’s a quick summary of our findings on online casinos in Cyprus. We’ve highlighted the top three options for players. These have everything you could need. They offer fantastic games and even give out favorable bonuses.

The table below covers everything you need to know about online casinos in the country:

In response to the significant rise in gambling in Cyprus, where betting surged by 22% in 2022 to €959 million, substantial efforts are underway to tackle addiction. Here’s how responsible gambling policies are promoted to protect players and foster a safe environment:

Many casinos provide links to professional organizations that offer support for problem gambling. These include:

Among these is establishing a dedicated treatment program in Famagusta and a potential screening initiative within the national health system.

Additionally, the Centre for Prevention and Treatment of Problematic and Pathological Gambling, driven by the Gaming and Casino Supervision Commission, focuses on prevention, treatment, and counseling. For immediate support, KENTHEA offers a confidential and free helpline (1422) for those struggling with gambling issues, staffed daily by trained professionals. They offer confidential advice, support hotlines, and counseling services for players who need assistance.

Online gambling is legal in Cyprus, but it's regulated by the Cyprus Gaming and Casino Supervision Commission, which issues licenses.

Tourists can access and play in casinos in Cyprus without verification, provided these platforms are licensed and regulated by Cypriot authorities.

The legal age for online gambling in Cyprus is 18 years, and age verification is mandatory for all licensed platforms.

Yes, gambling winnings in Cyprus are subject to taxation. The tax rate can vary, and players should consult local tax laws.