Best Online Casinos In Japan

⏲️ Reading time: 25 minutes

Online casinos are rapidly gaining popularity in Japan, marking a significant shift in the country's gambling trends. This rise is attributed to the diverse entertainment options these platforms offer. These features make online casinos particularly appealing to the local audience. Furthermore, the Japanese gambling industry, encompassing various forms of betting, is a multi-trillion yen sector, indicating the substantial role of gambling in Japanese society.

| Rank | Casino | Rating | Bonus | Get bonus |

|---|---|---|---|---|

| 1 | 4.8/5 | Bonus: 100% Welcome Bonus and 200 FS | ||

| 2 | 4.5/5 | Bonus: 480% Welcome Bonus Up to ¥150,000 + 400 FS | ||

| 3 | 4.5/5 | Bonus: 100% Welcome Bonus Up to 2,000,000 IDR + 120 FS | ||

| 4 | 4.8/5 | Bonus: Up to 470% Welcome Bonus + 400 FS | ||

| 5 |  Lex Casino | 4.8/5 | Up to 155 950 JPY + 400 FS from the first three deposits | Read review |

| 6 |  1xbet | 4.8/5 | Bonus: Welcome package up to 232318 YEN + 150 free spins | Read review |

| 7 |  Fresh Casino | 4.5/5 | Bonus: 100% welcome bonus up to 60,000 YEN | Read review |

| 8 |  Megapari | 4.8/5 | Bonus: 100% welcome bonus up to 220,500 JPY | Read review |

This guide provides comprehensive insight into the best online casinos in Japan. It covers bonuses, top apps, payment methods, and more.

Reputable online casinos in Japan are known for their secure and fair gaming practices. These are the best online casinos in Japan by category:

Gambling has woven itself into the tapestry of Japanese history, marking its presence since the eras of yore. During the Heian epoch, spanning 794 to 1185, games akin to backgammon captivated many, only to face prohibition in 689 AD.

As centuries unfolded, the rigidity of gambling regulations oscillated. By the 13th century, the stakes of indulging in such activities escalated dramatically, with transgressors risking harsh penalties, extending even to the solemnity of capital punishment.

The Tokugawa shogunate (1603-1868) saw further restrictions, with foreign playing cards banned in 1648. Hanafuda decks were used in secret gambling sessions organized by bakuto. They are the predecessors of modern Yakuza, who now run illegal activities, including underground casinos.

The Penal Code of 1907 banned all forms of gambling, reversing the trend of legalization that began in the early 1700s. While it is illegal to operate an online casino in the country, many Japanese players access offshore online gambling sites. The legality of using these international platforms remains unclear.

In recent years, Japan has shifted its position on casino gambling. The government passed a law in 2018 permitting the establishment of integrated resorts, with the first one slated to open in Osaka in 2029. This marks a significant change in Japan's gambling landscape as the country embraces casino gambling as a means to enhance tourism and local economies.

For instance, the Osaka project entails a $13.5 billion investment and is expected to attract roughly 20 million visitors annually, generating substantial economic benefits.

A complex regulatory framework governs online casinos in Japan. The Japan Casino Regulatory Commission oversees land-based casino gaming, while online gaming activities within Japan are prohibited.

The Integrated Resort (IR) Implementation Law, enacted in 2018, legalizes land-based gaming in IRs but maintains the prohibition on domestic online gaming and using casinos in Japan without verification.

Licenses for casino operations are limited to IR areas, with stringent requirements for operators, including compliance with technical and operational standards and adherence to strict anti-money laundering and customer protection measures. Casino operators are subject to national and municipal taxes based on Gross Gaming Revenue.

Despite the legalization of certain land-based gambling activities, the use of online crypto casino services, particularly those operated outside Japan, remains legally ambiguous, with instances of enforcement actions against illegal online gambling activities.

This regulatory environment aims to ensure responsible gambling, financial transparency, and protection from criminal activities while using virtual currencies in casinos is not permitted.

🇯🇵 Country Japan 🇯🇵 Language Japanese 💰 Currency Japanese Yen (JPY) 🎰 Popular Casino Games Pachinko, Slots machines, Blackjack, Baccarat, Craps, Poker, and Roulette 📜 Is Gambling Legal? Limited. Most forms of gambling are illegal, but there are exceptions for particular sports betting, pachinko, and lotteries. ⚖️ Gambling Regulator National Public Safety Commission ✅ Gambling Tax This varies depending on the type of gambling. 💳 Popular Payment Methods Cash, Credit Cards, E-Wallets

In the world of online casinos in Japan, a unique blend of regulations and practices shapes the industry. Here's an exploration of the Japanese Gambling Act and its stipulations:

Gambling Laws and Regulations in Japan underwent a transformative shift with the advent of the IR Promotion Law and the IR Implementation Law. These pivotal statutes opened the door for licensed casino activities within Integrated Resorts, charting a new course for the industry while maintaining prohibitions on other gambling forms.

The Japan Casino Regulatory Commission stands at the forefront of this regulatory landscape. Its approach, rooted in detailed scrutiny, requires IR operational plans to receive the green light from the Ministry of Land, Infrastructure, Transport, and Tourism.

The privilege of operating a casino is exclusive to IR operators. These free game casinos, functioning as multifaceted hubs with a blend of recreational, convention, and accommodation facilities, must navigate a tightly regulated licensing terrain.

Entering this sector demands a thorough vetting process, scrutinizing applicants' financial robustness and social trustworthiness. A casino business license, with its three-year lifespan, carries the potential for renewal or revocation, depending on adherence to standards.

The 2018 Basic Law on Measures Against Gambling Addiction mandates casino operators to instill robust mechanisms to curb gambling addiction, balancing accessibility with responsible gaming.

In alignment with global standards, Japan's real money casinos adhere to stringent anti-money laundering protocols, encompassing comprehensive KYC procedures and diligent transaction monitoring.

Advertising in this sector is tightly regulated, emphasizing the prevention of problem gambling and safeguarding minors, with severe penalties for transgressions.

1 Japanese Yen casino operators face a dual tax regime, contributing to national and municipal coffers based on their gross gaming revenue. Customer entrance fees augment this and are funneled to governmental authorities.

The Japan Casino Regulatory Commission wields considerable authority to ensure compliance, with a spectrum of sanctions at its disposal to maintain industry integrity.

In Japan, gambling taxes are structured to include both national and municipal levies on online casinos accepting players from Japan. The federal tax is a floating rate of 15% of the Gross Gaming Revenue (GGR) each month. This GGR is calculated as the total chip amount received from customers minus the amount refunded plus profits from customer betting.

In addition, there's a fixed tax covering the administrative expenses of the regulatory committee. The municipal tax also stands at 15% of the GGR per month. These taxes are payable to the Japanese government every month.

Furthermore, Japan imposes entrance fees on casino customers, excluding non-resident foreigners. This fee is 6,000 yen, split equally between the national (3,000 yen) and municipal (3,000 yen) entrance fees. Operators of new casinos in Japan are responsible for collecting these fees from customers and paying them to the government and municipal bodies monthly.

While regulated online casinos in Japan are still being considered, many Japanese players can still enjoy the thrill of playing in offshore online casinos. To help you make an informed decision, we have curated Japan's top 5 online casinos.

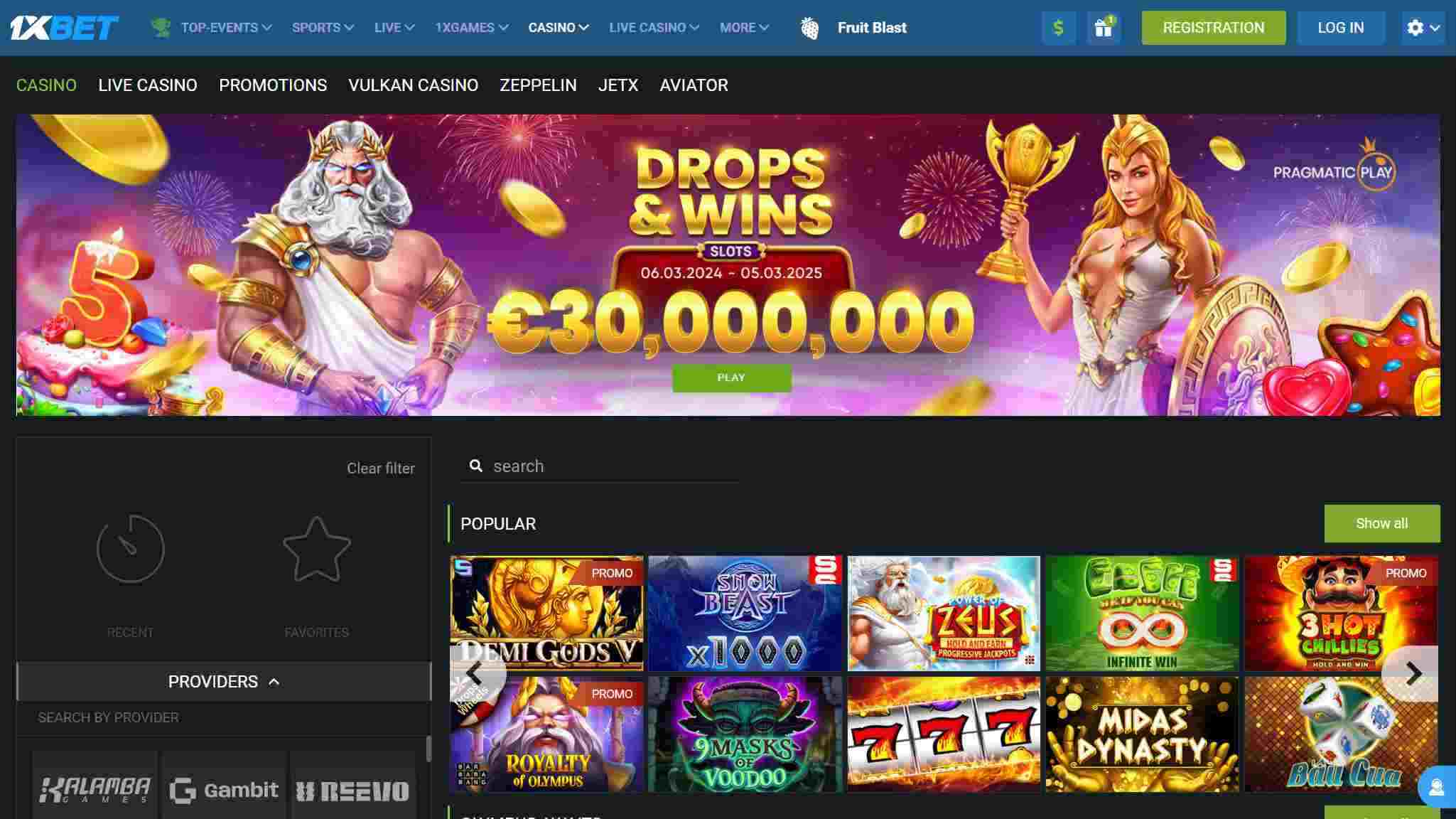

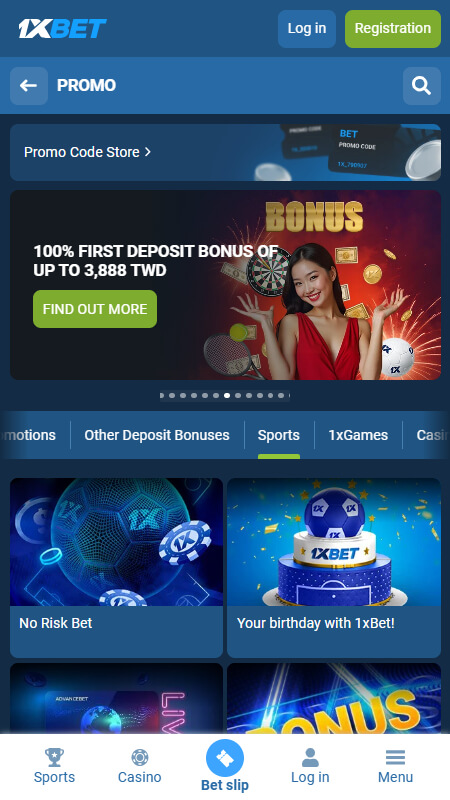

1xbet offers players a 100% welcome bonus of up to 16,000 JPY plus 150 free spins. The bonuses have a wagering requirement 35x that must be met within seven days of activating the bonus.

| 💰 Welcome Bonus | Up to 307,000 JPY plus 150 free spins |

| 🎲 Popular Casino Games | Slots, Blackjack, Roulette, eSports |

| ♠️ Suppliers | NetEnt, Microgaming, PragmaticPlay |

| 💳 Payment methods | Cryptocurrency, E-Wallets, Credit/Debit Cards, Bank Transfer |

| ⚠️ Minimum Deposit | 125 JPY |

| 💬 Customer Service | Email, Live Chat |

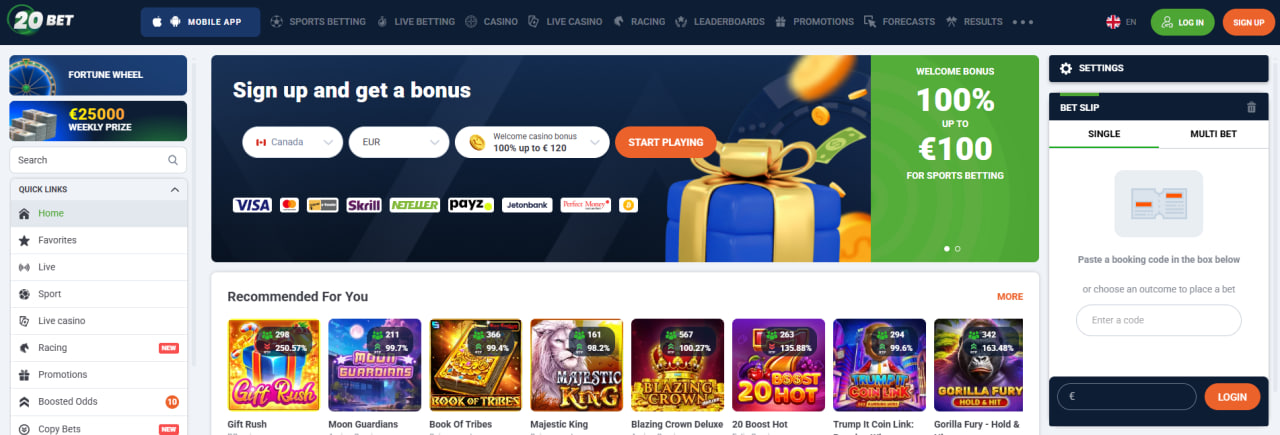

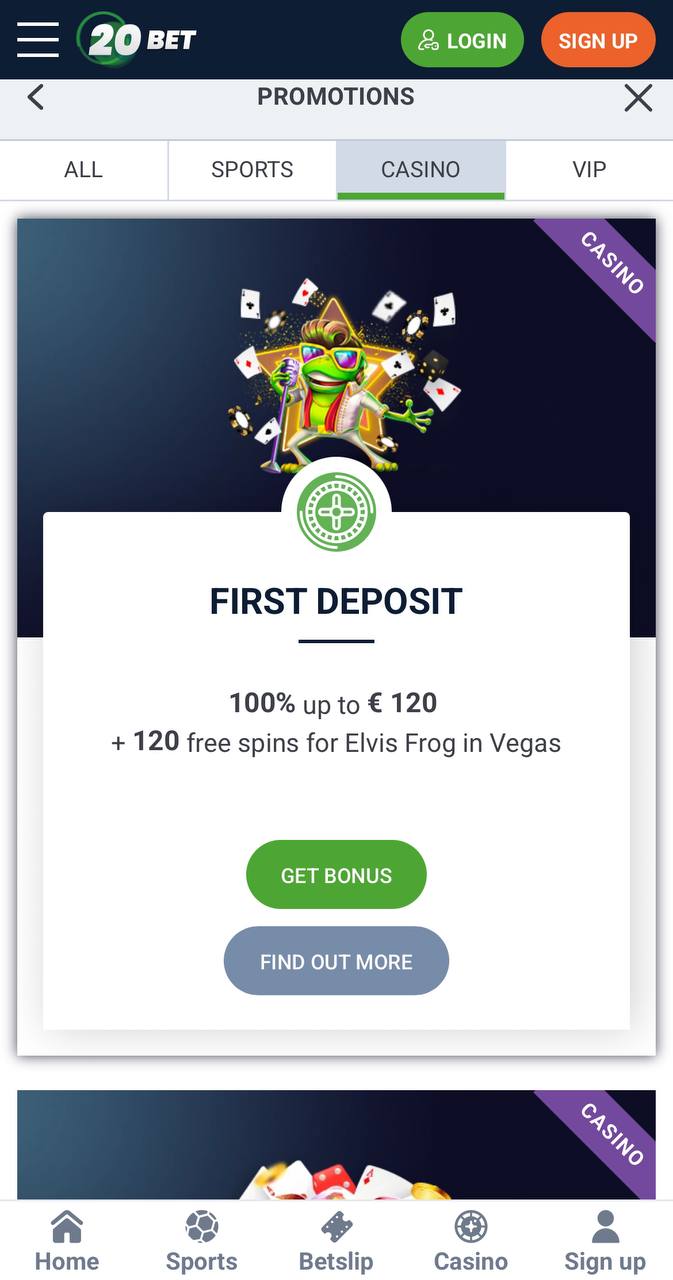

20bet is a user-friendly online casino that offers Japanese players up to 14,500 JPY plus 50 free spins

| 💰 Welcome Bonus | Up to 14,500 JPY plus 50 free spins |

| 🎲 Popular Casino Games | Slots, Live Casino, Blackjack |

| ♠️ Suppliers | Microgaming, Play’n’Go, NetEnt |

| 💳 Payment methods | Bank Transfers, Crypto, E-Wallets |

| ⚠️ Minimum Deposit | 150 JPY |

| 💬 Customer Service | Email, Live Chat |

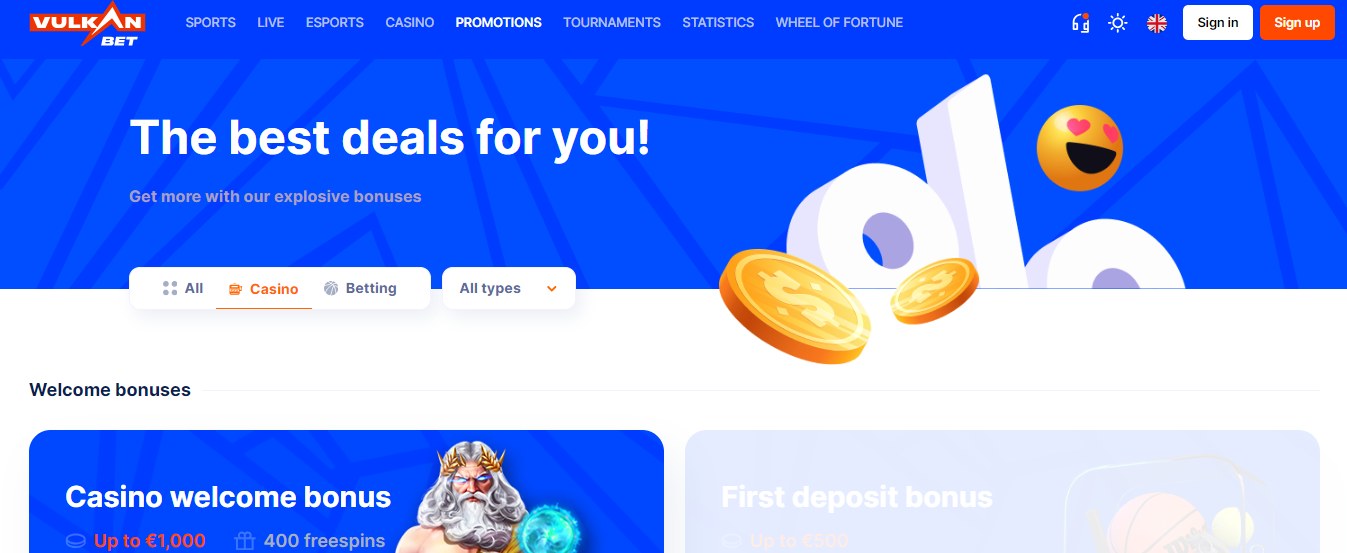

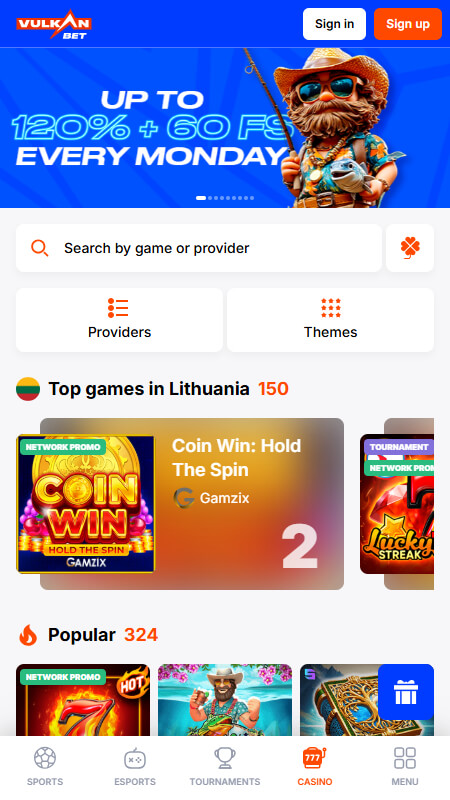

Japanese casino players who join Vulkanbet can enjoy a 100% matching deposit bonus of up to 23,500 JPY and 400 free spins on selected slot games.

| 💰 Welcome Bonus | 100% deposit bonus up to 23,500 JPY plus 400 free spins |

| 🎲 Popular Casino Games | Slots, Live Games, Blackjack, Roulette |

| ♠️ Suppliers | Pragmatic Play, NetEnt, Microgaming |

| 💳 Payment methods | Bank Transfers, E-wallets |

| ⚠️ Minimum Deposit | 150 JPY |

| 💬 Customer Service | Email, Live Chat |

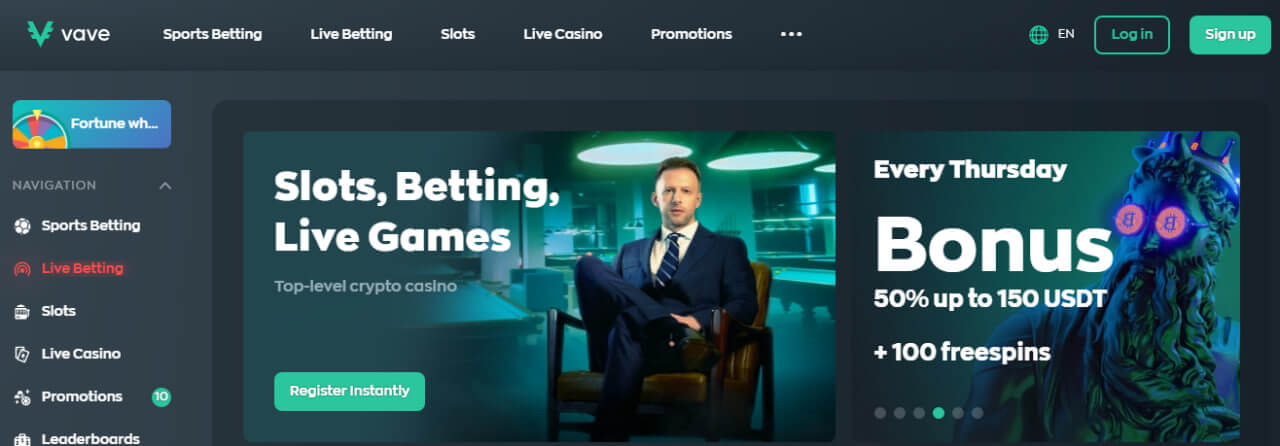

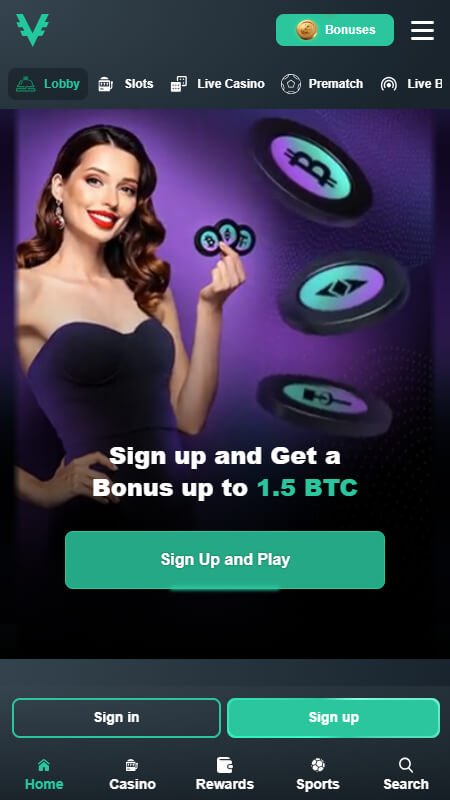

Vave is a major crypto casino that offers Japanese players a welcome bonus of up to 1BTC. To activate the bonus, players must deposit a minimum of 2,900 JPY.

| 💰 Welcome Bonus | 100% match bonus up to 6,000,000 JPY |

| 🎲 Popular Casino Games | E-sports, Virtuals, Slots, Blackjack |

| ♠️ Suppliers | NetEnt, Pragmatic Play, Play’n’Go |

| 💳 Payment methods | Cryptocurrency, E-Wallets |

| ⚠️ Minimum Deposit | 150 JPY |

| 💬 Customer Service | Email, Live Chat |

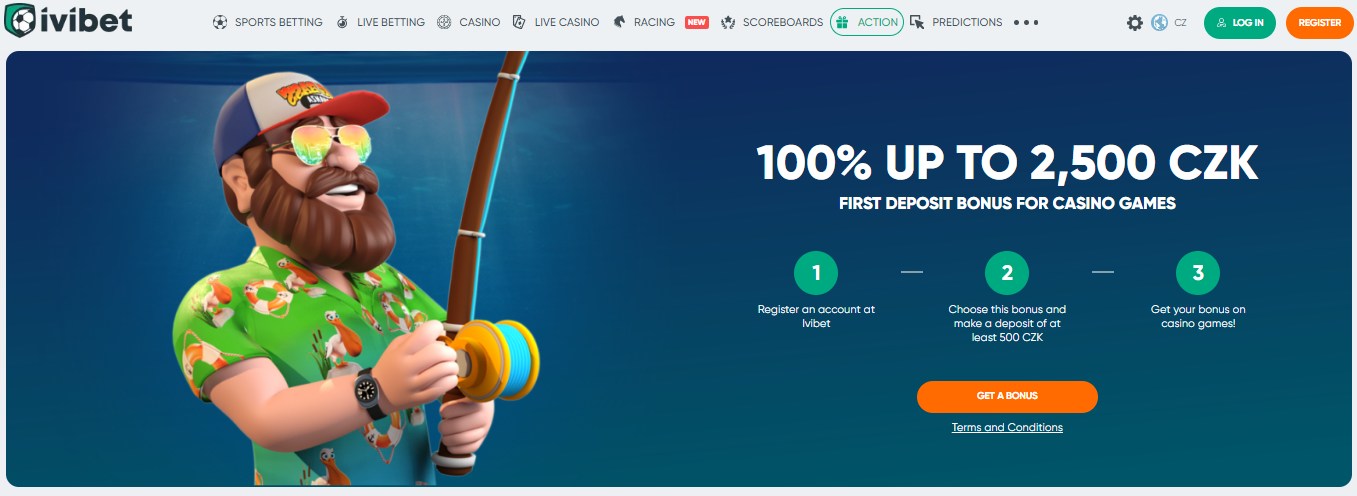

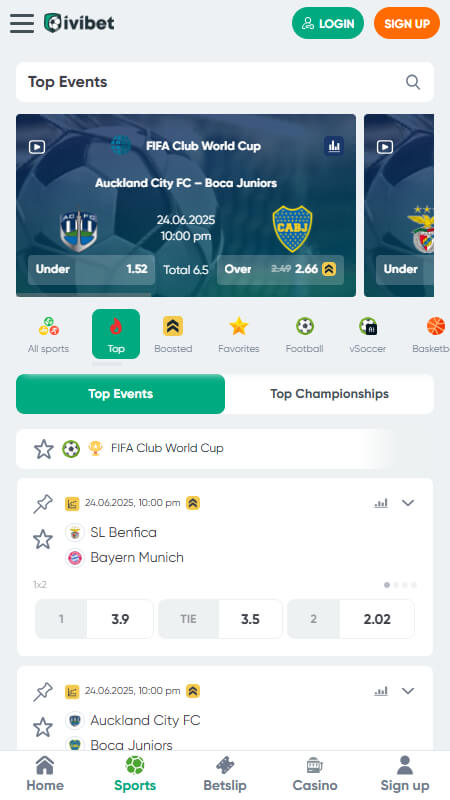

New Ivibet players can receive up to 47,000 JPY on their first deposit plus 170 free spins. However, specific wagering requirements must be met before a withdrawal can be made.

| 💰 Welcome Bonus | Up to 47,000 JPY + 170 free spins |

| 🎲 Popular Casino Games | Slots, Blackjack, Roulette |

| ♠️ Suppliers | Fugaso, GameArt, Pragmatic Play, 2by2, and many more |

| 💳 Payment methods | Bank Transfers, E-wallets Mobile Wallets, Cryptocurrency |

| ⚠️ Minimum Deposit | 150 JPY |

| 💬 Customer Service | Email, Live Chat |

We have examined key elements like welcome bonuses, security features, user interface, and payment methods to collate Japan's top 5 online casinos.

Casino Welcome Bonus Games Available Live Games Minimum Deposit (JPY) Withdrawal Time

Up to 307,000 JPY + 150 free spins Slots, blackjack, table games, roulette, baccarat, sport betting Yes 125 JPY Up to 24 hours

Up to 14,500 JPY + 50 free spins Slots, blackjack, table games, roulette, baccarat, sport betting Yes 150 JPY Up to 24 hours

Up to 23,500 JPY + 400 free spins Slots, blackjack, table games, roulette, baccarat, sport betting Yes 150 JPY Up to 24 hours

Up to 1btc Slots, blackjack, table games, roulette, baccarat, sport betting Yes 150 JPY Up to 48 hours

Up to 47,000 JPY + 170 free spins Slots, blackjack, table games, roulette, baccarat, sport betting Yes 150 JPY Up to 48 hours

We evaluate Japanese online casinos based on a number of important criteria. In doing this, we guarantee that Japanese players can have a secure and entertaining experience. Our criteria for review range from security to bonus offers and game selection. That said, below is an overview of our evaluations:

When assessing a Japanese online casino, we verify its license. Players want the casino to be honest and not exploit them. At regulated casinos, gamblers may be certain that their money is secure. Licensed establishments are overseen by reputable authorities that ensure fair play. Additionally, licensed casinos safeguard player interests.

Online casino trustworthiness is a key review factor in our review process. Top casinos protect the financial and personal data of players. They prevent third-party intrusions using cutting-edge security protocols, including encryption. Playing at secure casinos prevents fraud and data breaches.

Bonuses and promotions are the hallmarks of online gambling. Most gamers choose casinos based on the incentives they provide. The gaming experience may be greatly improved with a big bonus offering. It increases the chances of winning and allows gamers to play for longer.

We understand its importance, so we prioritize evaluating a casino’s bonus selection. For new players, we ensure that the casino has a welcome package. We look out for existing player promotions like VIP offers, free spins, and cashback. These casino incentives provide players with more value for their money.

We also take into account the available game variety. Top online casinos provide many slots and table games. In our review, we look out for live dealer alternatives.

Players may experience real-life gambling excitement with live casinos. We also check the software providers. In doing this, we can guarantee high-quality and fair gaming. Large libraries make gaming more exciting and engaging. They allow players to enjoy both their favorite titles and those they have never heard of before.

Payment methods are vital while assessing online casinos. The ability to choose from several payment methods is crucial. Credit cards, eWallets, prepaid cards, and cryptocurrencies are popular options.

Transactions should be simple, and there should be several options to satisfy all players. We also check if there are any transaction fees attached to these payment services. We evaluate how long it takes to process payments using these methods.

It is crucial to have customer service that is both responsive and educated. New players, in particular, might have queries or run into problems, so an active support channel is undoubtedly helpful.

The availability of channels like live chat, email, and phone is one way we measure support quality. If a casino has great customer service, it can solve problems fast. Consequently, players will have a good time playing on the betting platform.

Playing at the best online casino in Japan only requires a few easy steps. From registration to withdrawal, these casinos make the process easy. Below are the steps to play at Japanese casinos:

From our list of casinos, you can choose your most preferred option. Remember to check their features to determine suitability. Choosing the right casino elevates your gameplay.

After choosing a casino, it’s time to sign up. Within five minutes, you should have completed this process. You simply need to submit your information to the casino.

Fund your account to claim the bonus. Ensure to use an eligible payment method that can unlock the offer. Endeavor to meet the deposit requirement.

Once you’ve completed this process, you’ll have unlimited access to explore the games in the casino.

Online and land-based casinos have pros and cons. Being aware of these will help you determine the right option for you. So, below, we list the pros and cons of the service:

| Pros and cons | Online Casinos | Land-Based Casinos |

|---|---|---|

| 🎁 Bonuses | A wide selection of bonuses and promotions | Limited bonus variety |

| 💬 Customer support | 24/7 customer support | Support times are limited |

| 💯 Convenience | Available from anywhere | Players must travel to the location |

| ⚙️ Betting features | Access to more advanced betting features | Limited access to some betting features |

Online casino bonuses maximize playing time. New and existing players may use these offers to boost their gameplay. Listed below are the most typical bonus kinds offered by respectable online casinos to players in Japan.

To entice new customers, casinos provide welcome bonuses. These are usually given out right after registration. They may come in the form of free spins, a match bonus, or both. The bonus size may vary from 1,000 JPY up to 600,000 JPY or higher, depending on the casino.

By providing players with bet money or spins, this bonus enhances the initial experience. Also, it allows players to explore the casino’s options. It is often one of the best incentives offered; however, the specifics could differ depending on the platform. It comes along with conditions that players must meet before they can cash out any winnings deriving from it.

When a player makes their first deposit after registration, they will get this bonus. Players get funds in relation to the amount they deposit. The reward is set as a percentage of the deposit amount, often 100%.

This is a fantastic method to increase your starting balance. It allows you to play more games with less personal financial risk. Like most casino bonuses, this incentive has rollover requirements attached to it.

These usually come with casino welcome packages. These incentives give players free spins on different online slot games. These let gamers spin slot machine reels without risking real money.

Free spin bonuses frequently have wagering requirements. However, occasionally, casinos give them to players without any playthrough requirements. In this case, you can cash out your winnings right after using your free spins.

The spins must be used according to the rules. Players need to wager free spins winnings a number of times before they can withdraw. Casinos provide various free spin deals. Some casinos provide 100 of them, others up to 200.

To get this bonus, you have to find a casino that offers free spins on our recommended list. Choose one that you like and click on “Obtain Bonus” to register and claim the offer. Don’t forget to read the bonus requirements and choose the offer that suits you best.

Players can get a portion of their losses back over a specific time with a cashback. The cashback size might vary depending on the casino. Some casinos may give about 10% cashback, while others may offer up to 25%. A casino may offer cashback on a daily, weekly, or monthly basis.

Players are given another opportunity to recover and keep playing with cashback. With VIP programs, the cashback percentage is usually higher. Overall, this bonus serves to mitigate the impact of losses.

Gamblers can earn unique privileges such as cashback, free spins, and concierge services through VIP or loyalty programs. This is a reward for a player’s dedication to a betting platform. At most casinos, anyone can become a VIP, depending on their level of gaming.

Dedicated account managers and increased withdrawal limits are common benefits. Gaining a higher VIP rank and access to better deals is directly proportional to how much you play. It allows online casino regulars to enjoy exceptional treatment and value.

Online free spins casinos in Japan offer diverse payment methods, catering to different preferences and ensuring secure transactions. Each payment method offers unique advantages: convenience, speed, security, or anonymity.

Players are advised to choose the best new casinos that best suit their payment needs and be aware of any potential commissions the payment processing company applies. These methods can be categorized into several types:

Payment Options Deposit Time Withdrawal Time Deposit Limits Withdrawal Limits Available at: Maestro 1-3 business days 1-8 business days ¥1000 ¥1,000,000 888Starz Paypal Instant 1-5 business days ¥1000 ¥1,000,000 Pinnacle Paysafecard Instant N/A ¥1000 ¥25,000 Spin Palace Bank Transfer Instant 1-15 business days ¥1000 ¥1,000,000 Vera&John

An eclectic mix of games captivates traditionalists and modern gamers in Japan’s instant withdrawal casinos scene. At the forefront is Pachinko, an iconic mechanical game bearing a resemblance to vertical pinball, which has cemented its status as a national favorite.

The allure of time-honored casino classics such as Roulette, Blackjack, and Baccarat also resonates deeply with Japanese players, reflecting a global appreciation for these games. Slot machines, with their myriad themes and captivating gameplay, consistently draw in crowds, offering a kaleidoscope of entertainment.

Not to be overlooked, Craps holds its own as a well-regarded option in this diverse gaming landscape. Together, these games form a rich world that appeals to players at the best online casino in Japan, blending the quintessentially Japanese with the universally beloved.

Slots rule entertainment at both brick-and-mortar and online casinos. There are countless titles in this broad genre that suit various tastes. Slot machines provide casino players with hours of enjoyment.

There are classic 3- and 5-reel slots with stunning graphics and bonus features. A progressive jackpot slot can have a prize pool of millions, all thanks to the interconnection of several machines at multiple establishments.

Players spin the reels to match symbols across paylines. The simplicity of online slots makes them appealing. Up to 117,649 possible winning combinations are available in modern variants. These feature cascading reels, expanding wilds, and multi-win ways.

With the right strategies, blackjack offers players the best odds. Blackjack requires talent and tactics, not just luck. Even though casinos hate it, card counting is a great way to get ahead.

Basic strategy charts and odds calculators can find optimal hand combinations. Many popular variants of blackjack have been developed. Some examples are European Blackjack, American Blackjack, and Spanish 21. Each has its own set of rules and additional bets

Roulette, the unrivaled Queen of Casino Games, enchants players with its social vibe. Its live dealer versions deliver understated thrills. Bettors wager on the possible landing spots of a spinning ball. It goes from specific numbers to general categories like “red,” “black,” “odd,” or “even.”

Roulette boasts different variants, including the European and American versions. The former gives players slightly higher chances with one zero compared to the latter’s two zeroes. Although no strategy can ensure success, popular betting systems are helpful. These include Fibonacci, D'Alembert, and Martingale. Some other variants include speed roulette and French roulette with the “la partage” rule.

It used to be that only the rich could afford to play this high-stakes favorite. But now, everyone can enjoy this French game online. The “Player” or “Banker” hand closest to nine, or a tie, is the one on which players wager.

Cards follow specific drawing rules, removing player decision-making beyond initial betting. There are a few popular variants of the game, including the traditional French Chemin de Fer. There’s Mini-Baccarat with smaller stakes and EZ Baccarat, which does away with banker bet fees.

A wide variety of poker games are available in online casinos, meeting the needs of various players. Video poker offers a chance to practice strategy while also increasing the odds of winning. The goal of this five-card draw poker variation is to make winning hands.

Double Bonus Poker, Jacks or Better, and Deuces Wild are popular. Video poker, in contrast to slot machines, pays out for skill and optimum technique. Some variations have very high payout potential when played right.

Players on online casino sites in Japan have collectively won over $22 million in the last five years, averaging $9,137 per win. A standout player clinched a record $2,008,000 on LC MegaWheel at Ruby Fortune in 2023, marking the highest single win recently.

Other prominent winners include Weft, who won $805,428 on Millionaires Club III at InterCasino, and Katsuyuki Y, who won a $540,800 victory on Avalon at 7 Sultans. Yo K and Hiroshi N. also made significant gains with wins in the range of SEK 3,036,000 and $229,754, respectively, on games like 9 Masks Of Fire and European Blackjack Gold High Limit.

These achievements highlight the popularity and success of players in mobile casinos in Japan, especially in games like slot machines, video poker, and blackjack. Japan's online casino scene is vibrant, with players frequently enjoying various games and occasionally hitting large jackpots.

There are some excellent versions of betting platforms available for smartphones and tablets, demonstrating the commitment modern casinos take to mobile accessibility. These mobile platforms provide fluid gaming with HTML5 technology, eliminating the need for Flash plugins.

Most popular games, including recent launches, are compatible with mobile devices. However, not all games made the switch. With an internet connection, players can access games from any location. The gaming experience is smooth on both Android and iOS smartphones. Mobile casinos modify user interfaces to accommodate touch inputs and smaller displays. Additionally, these platforms keep all the payment options and security features that are used on the desktop versions.

The best online casinos in Japan prioritize mobile gamblers. So, aside from a mobile-optimized version, they have betting apps. These applications make it easy for players to access the platform whenever they want. Additionally, they are compatible with iOS and Android devices. That said, here are the top casino apps in Japan:

| Casino | iOS Rating | Android Rating | Best For | Download Size |

|---|---|---|---|---|

| 3.5 | 4.0 | Casino Bonuses and Promotions | 82 MB |

| 4.2 | 4.0 | Live Casino | 9.6 MB |

| N/A | 4.2 | Slot Games | 7.5 MB |

| N/A | N/A | Table Games | Shortcut (No download option) |

| N/A | 4.1 | Crypto Payments | 371 KB |

Live casinos provide players with the real deal from the convenience of their own homes. Real dealers run actual tables in studios, and players get high-definition video feeds of the action. These games take place in real time, in an authentic casino setting. Participants can talk with dealers and other players.

Live casinos provide the best of online and land-based gambling. They make gambling exciting with authentic casino visuals and social interaction. Popular live table games, such as blackjack, roulette, and baccarat, are all available to players.

Real-life dealers oversee every action in a live casino. Some of the standout features include the fact that the action is streamed from multiple camera angles. This involves comprehensive game statistics and a record of all bets. Additionally, players have the option of playing at multiple tables at once. The openness of a brick-and-mortar casino is preserved with this novel model. It also incorporates the ease and accessibility of online gambling.

Aside from established players in the industry, the Japanese betting scene welcomes new casinos. These casinos usually introduce modern betting features that improve the player experience. Below is a list of some new online casinos in Japan:

All these platforms offer a fresh perspective on casino gambling in Japan.

Online casinos in Japan face both growth opportunities and regulatory challenges. The future of online gambling paints a picture of robust growth and expanding horizons. This bustling market is poised to amass a staggering $6 billion, embarking on a steady upward climb at a 7.31% annual growth rate until 2027.

Shifting the focus to live casinos in Japan, a vibrant chapter unfolds: from a substantial $7.2 billion valuation in 2022, the market is forecasted to soar to a remarkable $10.7 billion by 2028. This trajectory, marked by a 6.3% compound annual growth rate, signals an era of dynamic expansion, reflecting the sector's increasingly significant economic impact.

Online casino gambling may seem confusing at first for new players. However, with a bit of research and information, beginners can get grounded. That said, here are some tips on how to win at online casinos:

Ultimately, winning at casino games goes beyond pure luck. You must apply strategy and stick to games that give you the best chances as a beginner.

Players should focus on legality, game variety, and security when selecting an online casino in Japan. Ensure a reputable authority licenses the casino, offers a wide range of games, including pachinko and slots, and provides robust data protection.

Prioritize minimum deposit casinos in Japan with Japanese language support, user-friendly interfaces, and reliable customer service. Choose casinos with convenient payment options for Japanese players and verify the presence of responsible gaming resources for a safe gambling experience.

In Japan, the shadow of gambling addiction looms large. A survey by the Ministry of Health, Labor, and Welfare paints a concerning picture: around 3.2 million adults, or 3.6% of the population, have battled with gambling addiction.

This figure startlingly eclipses those seen in other advanced nations. Additionally, about 5.36 million Japanese adults are likely trapped in the cycle of pathological gambling, unable to resist the lure of the game. Also, online casinos in Japan provide several tools to encourage responsible gambling. These include options for:

To combat this issue, Japan has several key organizations and initiatives. The Headquarters for Gambling Addiction Countermeasure Promotion, operating under the Cabinet Secretariat and led by Chief Cabinet Secretary Yoshihide Suga, focuses on national strategies.

Osaka has taken proactive steps by enacting an ordinance to promote counter-addiction measures, especially in anticipation of the city hosting an integrated resort and casino. These include plans for treatment and recovery facilities.

Players can get help with problem gambling through the following:

While Japan's laws don't explicitly legalize no-deposit bonus casinos, many Japanese players safely use offshore sites due to a regulatory grey area.

Pachinko, slots, baccarat, and blackjack are highly popular, blending traditional Japanese games with classic casino offerings.

Yes, winnings from online gambling are subject to taxation, and players must declare and pay taxes on their winnings.

The best fast payout casino catering to Japanese players accepts Yen (JPY) and other currencies and payment methods.